Corporate Governance Structure

Related Documents

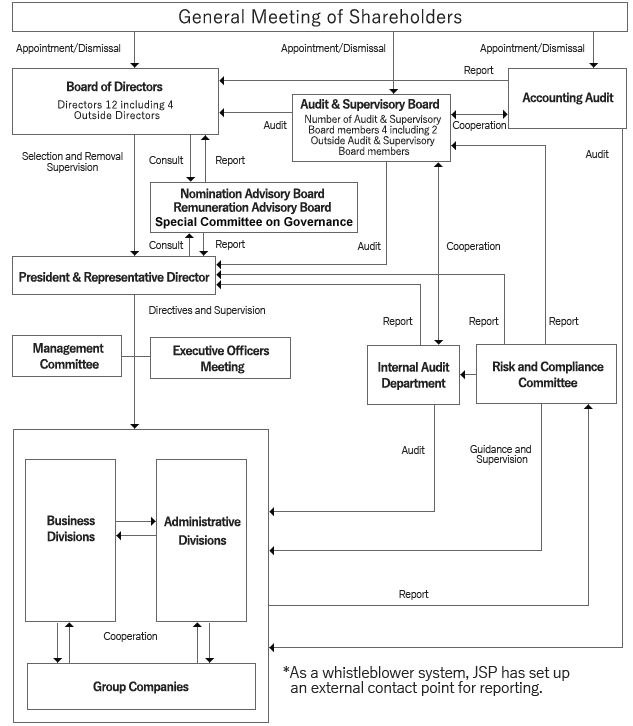

Organizational Structure

Company with an Audit & Supervisory Board

Corporate Governance Structure

Board of Directors

As stipulated in the Articles of Incorporation, JSP maintains a Board of Directors comprising up to 16 directors. The Board of Directors is chaired by the President & Representative Director and consists of 12 members, including 8 Executive Directors and 4 independent Outside Directors. The Board of Directors meets once a month in principle to deliberate and make decisions on matters stipulated by law and the Articles of Incorporation as well as important management matters, and to supervise the execution of business operations.

JSP has appointed 4 independent Outside Directors to further strengthen our governance. In light of our situation with the majority shareholders, we have established a special committee and are preparing to establish a system to deliberate in advance on matters of conflict of interest between the majority shareholders and minority shareholders.

| Chairperson | President & Representative Director |

|---|---|

| Number of Directors | 12 including 4 Outside Directors |

| Chair of the Board of Directors | 1 year |

| Establishment of Voluntary Advisory Boards |

Nomination Advisory Board Remuneration Advisory Board Special Committee on Governance |

Audit & Supervisory Board

As stipulated in the Articles of Incorporation, JSP maintains an Audit & Supervisory Board comprising up to four members. The Audit & Supervisory Board is chaired by a full-time member and consists of four members: two internal and two external members. In principle, the Audit & Supervisory Board members meet once a month to conduct hearings with the persons in charge of each business and to audit the legality and appropriateness of the Group's operations. Independent Outside Directors also attend the Audit & Supervisory Board to share information and promote cooperation.

| Number of Audit & Supervisory Board members | 4 including 2 Outside Audit & Supervisory Board members |

|---|

Voluntary Advisory Organizations

Nominating Advisory Board

JSP's Nominating Advisory Board is chaired by the top independent Outside Director and consists of a majority of independent Outside Directors. In selecting candidates for Directors and Audit & Supervisory Board members, the Board selects suitable candidates who are able to fulfill their duties and responsibilities, have the experience, knowledge, and abilities necessary to create medium- to long-term corporate value, and are suitable for the position, and reports to the President & Representative Director.

Remuneration Advisory Board

JSP's Remuneration Advisory Board is chaired by the top independent Outside Director and is composed of a majority of independent Outside Directors. The Board reports to the President & Representative Director on the remuneration of each Director, taking into consideration the overall business environment, business conditions, performance, financial condition, and the contribution of each individual.

Special Committee on Governance

Although the Company does not hold a controlling shareholder, Mitsubishi Gas Chemical Company, Inc. and its subsidiaries (the MGC Group), the former parent company of the Company, hold over 47% of the Company's voting rights and maintain a certain degree of influence over the Company. In light of this situation, the Company will continue to hold the Special Committee on Governance, an advisory body to the Board of Directors, to appropriately protect the interests of minority shareholders and enhance corporate governance.

JSP's Special Committee on Governance consists of at least three independent Outside Directors. The committee deliberates and reports on transactions with the parent company's group in response to inquiries from the Board of Directors, with the aim of appropriately protecting the interests of minority shareholders and enhancing corporate governance by ensuring fairness, transparency, and objectivity in transactions between the Company and the MGC group.

List of Officers and Skills Matrix

Based on the recognition that the most important management issue is to continue sustainable business growth and increase corporate value, JSP has adopted the corporate philosophy of "Creatively and Actively Contribute to Society" and aims for the management to earn the trust and satisfaction of all stakeholders as a globally competitive company with an emphasis on safety and environmental responsiveness.

We have also identified seven areas in which the Board of Directors should prepare for the realization of "A Global Company for Global Society”, which is the aspiration set forth in our long-term vision "VISION2027”, which sets forth the long-term direction of the Company.

In addition, in order to improve the effectiveness of the Board of Directors, we have listed below the areas in which we particularly expect individual Directors and Audit & Supervisory Board members to perform.

| Business Administration & Global Management | Business Strategy & Marketing |

ESG* |

Finance & Accounting | Personnel Affairs & Development of Human Resources | R&D | Production Technology and Quality Control | ||

|---|---|---|---|---|---|---|---|---|

| Directors | Tomohiko Okubo | 〇 | 〇 | 〇 | 〇 | |||

| Koichi Wakabayashi | 〇 | 〇 | 〇 | 〇 | ||||

| Yasuo Oikawa | 〇 | 〇 | 〇 | 〇 | ||||

| Kosuke Uchida | 〇 | 〇 | 〇 | 〇 | ||||

| Yasushi Komori | 〇 | 〇 | 〇 | 〇 | ||||

| Yoshikazu Shima | 〇 | 〇 | 〇 | 〇 | ||||

| Tomoyuki Kiura | 〇 | 〇 | 〇 | |||||

| Yoshihisa Ishihara | 〇 | 〇 | 〇 | 〇 | ||||

| Hisashi Shinozuka | 〇 | 〇 | 〇 | 〇 | ||||

| Takayuki Ikeda | 〇 | 〇 | 〇 | 〇 | ||||

| Kiyoshi Itou | 〇 | 〇 | 〇 | 〇 | ||||

| Ryoko Sugiyama | 〇 | 〇 | 〇 | 〇 | ||||

| Audit & Supervisory Board members | Makoto Ogawa | 〇 | 〇 | 〇 | 〇 | |||

| Yoshiaki Sawada | 〇 | 〇 | 〇 | |||||

| Hideki Honda | 〇 | 〇 | 〇 | |||||

| Yoshiyuki Kawakami | 〇 |

*Environment, Society and Corporate Governance

Up to four areas of expectation for each person are listed.

The above list does not represent all of the knowledge and experience possessed by each person.

Evaluation of Board of Directors’ effectiveness

JSP conducts an annual questionnaire to the members of the Board of Directors for assessing the effectiveness of the Board of Directors. The Board of Directors analyzes and evaluates the results of the questionnaires and the opinions of the independent Outside Directors and Outside Audit & Supervisory Board members with respect thereto. (Article 26 of the Corporate Governance Guidelines)

For a summary of the most recent evaluation of the effectiveness of the Board of Directors, please refer to the Corporate Governance Report, [Supplemental Principle 4-11-3 Analysis and Evaluation of the Overall Effectiveness of the Board of Directors].

Remuneration

Remuneration for directors (excluding part-time directors) is configured as base compensation and reserve-type remuneration to be paid upon retirement.

Base compensation comprises fixed compensation, short-term performance-linked compensation, and executive shareholder association-contributed compensation. Among the base compensation, fixed compensation and executive shareholder association contributed compensation are determined according to the responsibilities of each position.

The compensation for part-time directors and Audit & Supervisory Board members comprises fixed compensation in the form of base compensation.

The President & Representative Director, authorized by the Board of Directors, prepares the proposed amount of remuneration for each director for the current fiscal year within the remuneration limit resolved at the General Meeting of Shareholders, in accordance with the Company's Executive Remuneration Regulations, taking into consideration the business environment, operating conditions, performance, financial condition, each individual's contribution and other factors.

The President & Representative Director consults the Remuneration Advisory Board, which is composed of the Representative Director and the Outside Directors and chaired by the top Outside Director, on the proposed amount of compensation.

The Remuneration Advisory Board then reports to the President & Representative Director on the proposed amount of remuneration discussed. The President & Representative Director determines the amount of remuneration for each director based on the report of the Remuneration Advisory Board.

The remuneration for each Audit & Supervisory Board member is determined by consultation among the Audit & Supervisory Board members within the remuneration limit resolved at the General Meeting of Shareholders, taking into consideration the contribution of each individual.

-

① Details of performance indicators selected as the basis for calculating the amount of performance-linked remuneration, etc.

Performance-linked remuneration consists of short-term performance-linked remuneration as part of base remuneration and midterm performance-linked remuneration as part of reserve-type retirement remuneration. For both types of remuneration, performance indicators (consolidated net sales, consolidated operating income, consolidated operating margin, and net income attributable to shareholders of the parent company) determined by the Board of Directors are used as the basis for calculating the amount of remuneration.

-

② Reason for selection of the relevant performance indicators

The reason for selecting these indicators is that they are important management indicators showing the growth potential and profitability of the Company.

-

③Method of calculating the amount of performance-linked remuneration, etc.

Short-term performance-linked remuneration is determined by the performance ratio during the subject period against the base value of the above performance indicators determined by the Board of Directors. The reserve-type retirement remuneration is determined as a midterm performance-linked remuneration by calculating the cumulative amount of performance indicators for the relevant consolidated midterm business plan period at the end of the fiscal year as a percentage of the performance indicators achieved during the same period of the previous consolidated midterm business plan.

Training for Directors and Audit & Supervisory Board Members

The Company has established a training policy for Directors and Audit & Supervisory Board members to provide them with ongoing opportunities to acquire the knowledge necessary to perform their duties. (Article 28 of the Corporate Governance Guidelines)

Training Policy for Directors and Audit & Supervisory Board Members

- ①When a Director or Audit & Supervisory Board member is newly appointed, information necessary for the execution of duties by the officer shall be provided as appropriate through lectures and training by outside experts. After assuming office, training on management issues and legal revisions shall be provided on an ongoing basis.

- ②When an independent Outside Director or Outside Audit & Supervisory Board member is newly appointed, the person shall be encouraged to understand the Company's management philosophy and corporate culture and shall be provided with an inspection tour of major business locations and an explanation of business activities. After assuming office, the Company shall continue to provide information on management issues and other matters as appropriate.

- ③For the business plan and annual budget policy, an annual policy meeting will be held every fiscal year to provide an opportunity to share information throughout the company.

Information Provision and Support System for Directors and Audit & Supervisory Board Members

The Company shall establish a support system to ensure that Directors and Audit & Supervisory Board members have access to the information necessary to effectively fulfill their roles and responsibilities. (Article 27 of the Corporate Governance Guidelines)

- ①The secretariat of the Board of Directors shall collect and provide information as necessary for Directors and Audit & Supervisory Board members to perform their duties.

- ②Audit & Supervisory Board members may request the appointment of employees to assist them in their audit duties, and when such employees assist them in their audit duties, shall not be subject to the direction and orders of Directors, etc.

Independent Directors and Audit & Supervisory Board Members

Criteria for independent Outside Directors and Outside Audit & Supervisory Board members

Based on the independence standards established by the Financial Instruments Exchanges, we have established our own criteria for determining independence, which we disclose in the notice of Ordinary General Meeting of Shareholders, Annual Securities Report, and other documents. With regard to candidates for independent Outside Directors, the Company selects individuals who not only satisfy the criteria for independence set forth by financial instruments exchanges and the Company's criteria for determining the independence of Outside Directors as described below, but who also have a sufficient understanding of the Company's corporate philosophy, etc. and are expected to contribute to the Company's management.

Criteria for Independence of Outside Directors and Outside Audit & Supervisory Board Members

An Outside Director or Outside Audit & Supervisory Board member of the Company shall be deemed not to be independent if any of the following items applies to him/her.

1. The Outside Director or Outside Audit & Supervisory Board member (himself/herself) falls under any of the following.

- (1) Is currently or has been in the past, a Director, Audit & Supervisory Board member, Executive Officer, Operating Officer, manager or other employee of the Company and its subsidiaries (hereinafter referred to as the "the JSP Group").

- (2) Is currently or has been within the past three years, a shareholder holding 10% or more of the voting rights of the Company (hereinafter referred to as the "Major Shareholder"), or a Director, Audit & Supervisory Board member, Executive Officer, Operating Officer, manager or other employee of a corporate group consisting of a company and its subsidiaries (hereinafter referred to as the "Major Shareholder Group") if the Major Shareholder is a corporation.

- (3) Is a Director, Audit & Supervisory Board member, Executive Officer, Operating Officer, manager or other employee of a business partner, etc. or a corporation if such business partner, etc. is a corporation that falls under any of the following.

① Business partners that have paid on average 2% or more of the Company's annual consolidated net sales to the JSP Group over the past three years.

② Suppliers that have received, on average, 2% or more of their annual consolidated net sales from the JSP Group over the past three years.

③ Lenders to whom the JSP Group currently owes an amount equivalent to 2% or more of the Company's total consolidated assets.

- (4) Is a lawyer, certified public accountant, tax accountant, or other consultant who has received on average annual remuneration of 10 million yen or more from the JSP Group over the past three years other than remuneration as a Director or Audit & Supervisory Board member (or, if an organization has received the remuneration, a member of such organization).

2. The spouse or a relative within the second degree of kinship of the Outside Director or Outside Audit & Supervisory Board member falls under any of the following.

- (1) Is currently or has been in the past, a Director, Audit & Supervisory Board member, Executive Officer, Operating Officer, manager or other employee of the JSP Group.

- (2) Is currently or has been within the past three years, the Major Shareholder, or a Director, Audit & Supervisory Board member, Executive Officer, Operating Officer, manager or other employee of the Major Shareholder Group if the Major Shareholder is a corporation.

- (3) Is a Director, Audit & Supervisory Board member, Executive Officer, Operating Officer, manager or other employee of a business partner, etc. or a corporation if such business partner, etc. is a corporation that falls under any of the following.

① Business partners that have paid on average 2% or more of the Company's annual consolidated net sales to the JSP Group over the past three years.

② Suppliers that have received, on average, 2% or more of their annual consolidated net sales from the JSP Group over the past three years.

③ Lenders to whom the JSP Group currently owes an amount equivalent to 2% or more of the Company's total consolidated assets.

- (4) Is a lawyer, certified public accountant, tax accountant, or other consultant who has received on average annual remuneration of 10 million yen or more from the JSP Group over the past three years other than remuneration as a Director or Audit & Supervisory Board member (or, if an organization has received the remuneration, a member of such organization).

Outside Directors

| Name | Attribution | Supplement of Applicable Items | Reason for Appointment |

|---|---|---|---|

| Hisashi Shinozuka | From Another Company | - |

Mr. Hisashi Shinozuka has abundant experience and discernment as a management executive, having served as president and in other positions of local subsidiaries of companies that engage in business globally. We expect that he will utilize the above abundant experience, etc. to contribute to ensuring the reasonableness and appropriateness of our decision-making, mainly with advice on overseas business expansion and recommendations on important personnel affairs and remunerations for officers as a member of the voluntary Nominating Advisory Board, Remuneration Advisory Board and Special Committee on Governance, and protection of minority shareholders’ interests among others. He has no personal, capital, business, or other significant interests in the Company and we therefore believe that his independence as an Outside Director of the Company has been secured. In addition, he is designated as an independent director because he is considered to have no potential conflict of interest with general shareholders. |

| Takayuki Ikeda | From Another Company | - |

Mr. Takayuki Ikeda has abundant experience and discernment for overall management, having served for a long time as president of a company that engages in business globally. We expect that he will utilize the above abundant experience, etc. to contribute to ensuring the reasonableness and appropriateness of our decision-making, mainly with advice on strengthening the management base and recommendations on important personnel affairs and remunerations for officers as a member of the voluntary Nominating Advisory Board, Remuneration Advisory Board and Special Committee on Governance, and protection of minority shareholders’ interests among others. He has no personal, capital, business, or other significant interests in the Company and we therefore believe that his independence as an Outside Director of the Company has been secured. In addition, he is designated as an independent director because he is considered to have no potential conflict of interest with general shareholders. |

| Kiyoshi Itou | From Another Company | - |

Mr. Kiyoshi Itou has abundant achievements and experience in the overall management, having been involved in corporate management for a long time. We expect that he will utilize the above abundant achievements and experience to contribute to ensuring the reasonableness and appropriateness of our decision-making, mainly with advice on strengthening the management base and recommendations on important personnel affairs and remunerations for officers as a member of the voluntary Nominating Advisory Committee, Remuneration Advisory Board and Special Committee on Governance, and protection of minority shareholders’ interests among others. He has no personal, capital, business, or other significant interests in the Company and we therefore believe that his independence as an Outside Director of the Company has been secured. In addition, he is designated as an independent director because he is considered to have no potential conflict of interest with general shareholders. |

| Ryoko Sugiyama | From Another Company | - |

Ms. Ryoko Sugiyama is an expert in environmental and waste issues and has served as an external director of several listed companies for a long time and has extensive knowledge and experience in sustainability. We believe that she will be able to apply her wealth of knowledge and experience to contribute to ensuring the reasonableness and appropriateness of our decision-making, mainly with advice on sustainability management, recommendations on important personnel affairs and remunerations for officers as amember of the voluntary Nominating Advisory Committee, Remuneration Advisory Board and Special Committee on Governance, and protection of minority shareholders’ interests among others. She has no personal, capital, business, or other significant interests in the Company and we therefore believe that her independence as an Outside Director of the Company has been secured. In addition, she is designated as an independent officer because she is considered to have no potential conflict of interest with general shareholders. |

Outside Audit & Supervisory Board Members

| Name | Attribution | Supplement of Applicable Items | Reason for Appointment |

|---|---|---|---|

| Yoshiaki Sawada | From Another Company | Mr. Yoshiaki Sawada is from Nippon Life Insurance Company and left the company at the end of March 2018. The company owns 0.80% of JSP's shares and is also JSP's funding source. The company's share of JSP's total outstanding loans as of March 31, 2023 was 2.50%. The amount borrowed from the company was less than 0.5% of total consolidated assets as of March 31, 2023. |

Mr. Yoshiaki Sawada has extensive knowledge and experience at financial institutions. We believe that he will be able to apply his wealth of knowledge and experience to our auditing work. As noted on the left, Mr. Sawada is a former employee of Nippon Life Insurance Company but there are no special transactions between the company and JSP in the course of business activities. He has no personal, capital, business or other significant interests in JSP. In addition, he is designated as an independent director because he is considered to have no potential conflict of interest with general shareholders. |

| Yoshiyuki Kawakami | Lawyer | Mr. Yoshiyuki Kawakami is the partner of Tanabe & Partners. JSP has entered into a legal advisory agreement with Mr. Yoshiyuki Kawakami of the same law firm and the amount of compensation paid by the Company to the law firm for the fiscal year ended March 31, 2023 was 3,000 thousand yen. | Mr. Yoshiyuki Kawakami has abundant experience as a lawyer and advanced knowledge of law and compliance. We believe that he will be able to apply this wealth of knowledge and experience to the Company’s auditing services. He has no personal, capital, business, or other interest in the Company and we therefore believe that his independence as an Outside Audit & Supervisory Board member of the Company has been secured. In addition, he is designated as an independent officer because he is considered to have no potential conflict of interest with general shareholders. |